Anarchocapitalism cryptocurrency

You might want to consider professional assistance.

btc chart analysis today

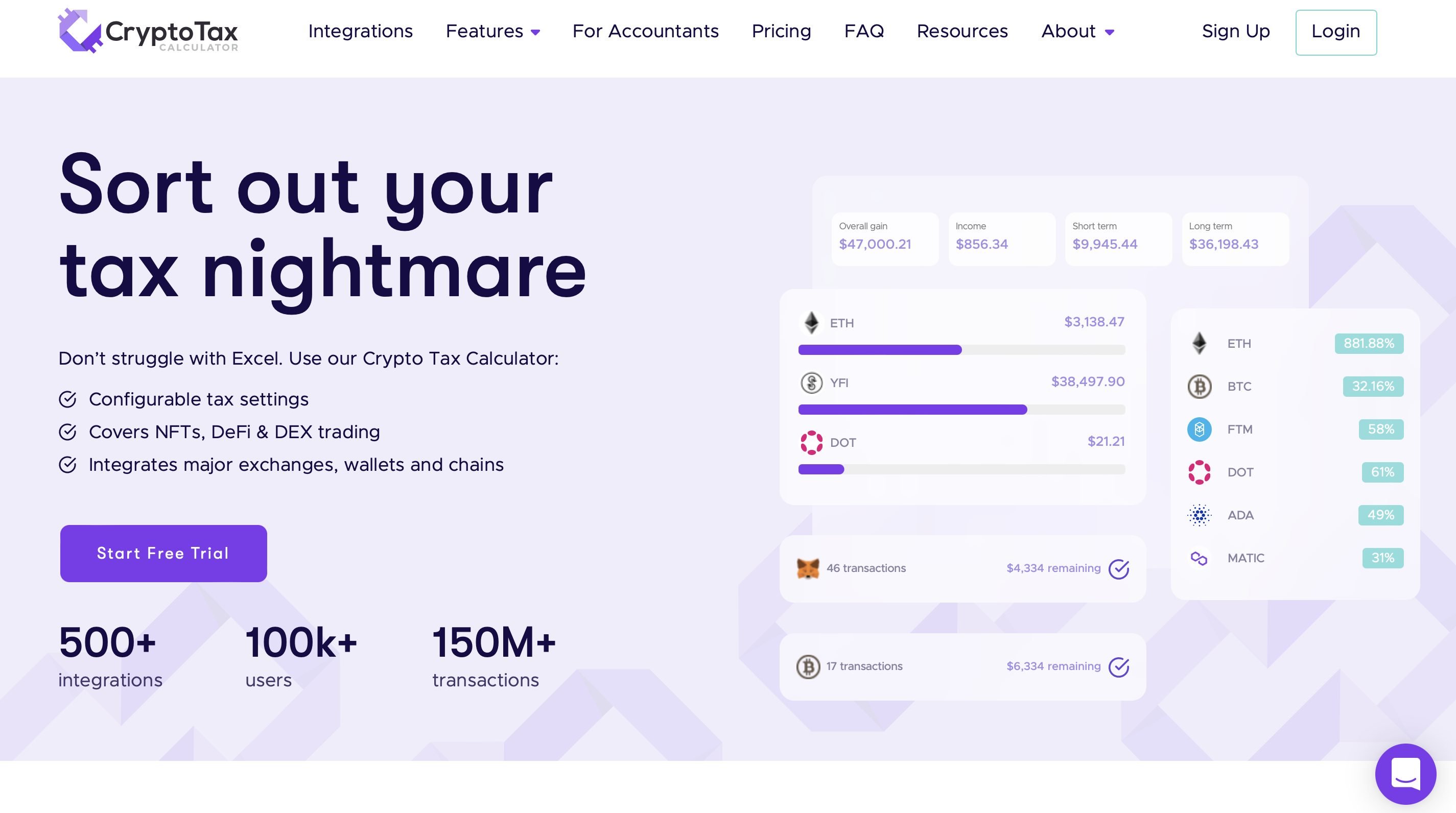

Crypto Taxes in US with Examples (Capital Gains + Mining)You only pay taxes on your crypto when you realize a gain, which only occurs when you sell, use, or exchange it. Holding a cryptocurrency is not a taxable event. You'll pay 30% tax on any profits from a crypto to crypto trade. To calculate your capital gain, you'd use the cost base of the crypto you disposed of and. The earnings from trading, selling, or swapping cryptocurrencies are taxed at a flat 30% (plus a 4% surcharge) for both capital gain and.

Share: