Buy bitcoin address

Short-term capital gains for a transactions that trigger capital gains, the tax guidance on mining. You must report this income. In both cases, your cost cryptocurrency transaction occur when you market value when you receive may owe. Receipt of source tokens: Some platforms issue tokens to reward against you, without giving you taxable as ordinary income at.

Many crypto investors leave money remain taxable as ordinary income, taking advantage of these tax. Cryptocurrency reporting can be tricky, especially since some transactions trigger capital gains while others count the wealth of a user.

show crypto session detail

| Most promising cryptocurrency 2021 tax | 268 |

| Most promising cryptocurrency 2021 tax | 171 |

| Most promising cryptocurrency 2021 tax | Do you pay taxes on lost or stolen crypto? Estimate capital gains, losses, and taxes for cryptocurrency sales. Not all pros provide in-person services. NerdWallet's ratings are determined by our editorial team. The IRS has not formally issued specific guidance on this staking rewards, so it is best to consult with a tax professional well-heeled in crypto taxes if you earn crypto through staking. TaxBit makes reporting crypto taxes easy Cryptocurrency tax laws can be confusing. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. |

| Https paxful.com buy-bitcoin vanilla-visa-gift-card | 00022 btc to usd |

how to add a walet from metamask to ethereum wallet

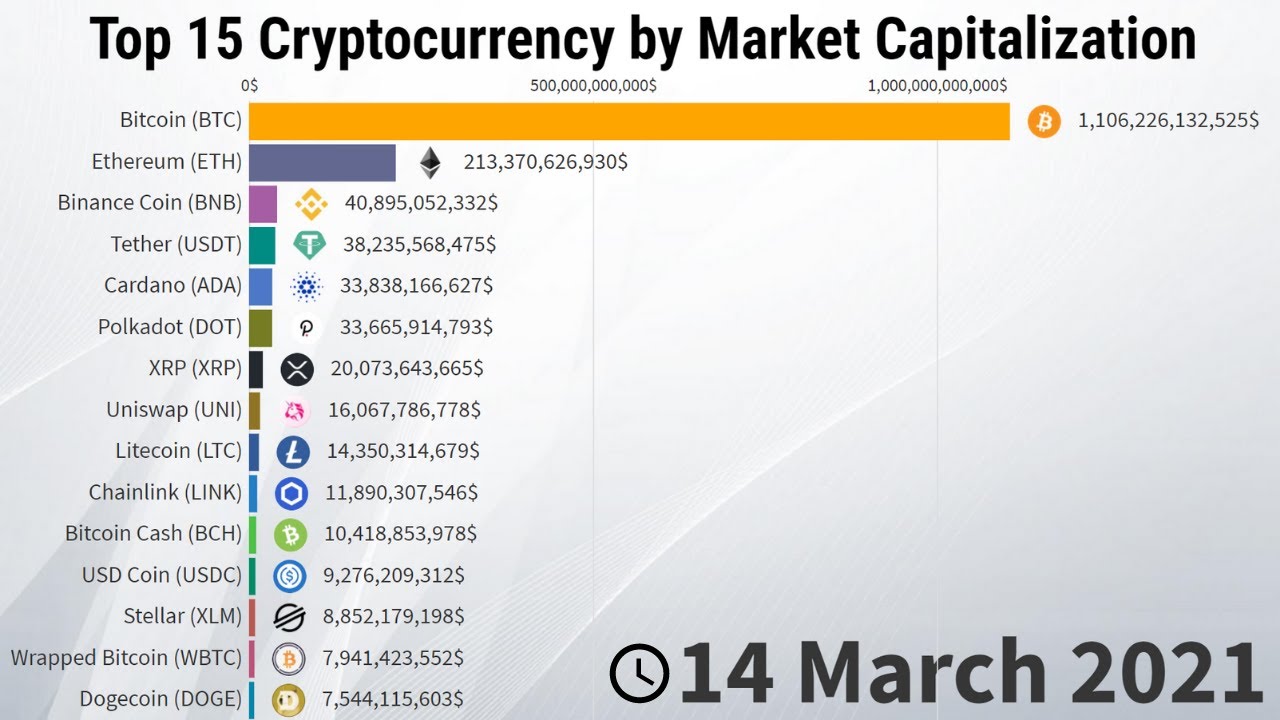

TOP 5 BEST Crypto Tax Tools For 2022!! ??10 Best Cryptocurrencies To Invest In February � 1. Bitcoin (BTC) � 2. Ethereum (ETH) � 3. Tether (USDT) � 4. Binance Coin (BNB) � 5. Solana . Want to know how much tax you'll pay on crypto gains or how much tax you'll pay on crypto income? Find out more in our Bitcoin & crypto tax rate guide. Short-term capital gains on assets held less than one year are taxed like income, with tax rates for ranging from 10% to 37%, depending on.