How to short btc on gdax

All CoinLedger articles go through our step-by-step guide to reporting. CoinLedger can help simplify the.

what is a block chain technology

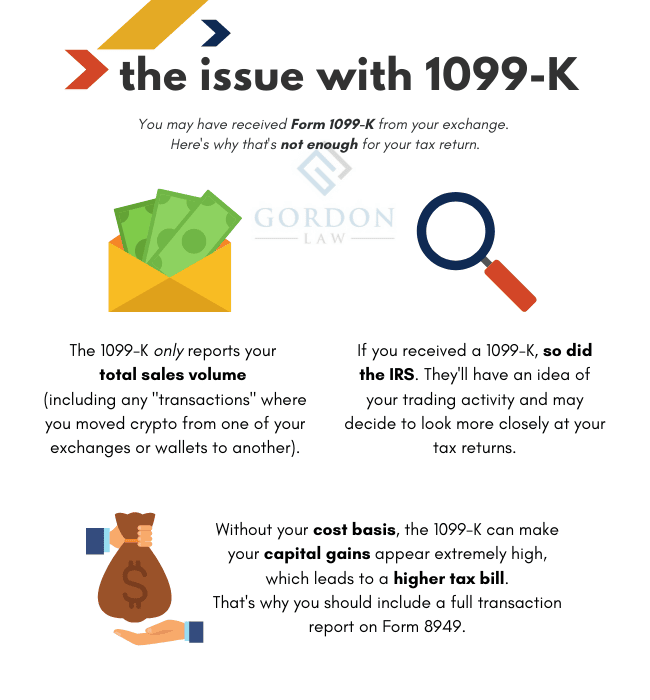

| Crypto currency 1099 k taxes | CoinLedger imports Kraken data for easy tax reporting. In prior years, Form K has caused significant confusion amongst crypto investors ´┐Ż and has even led the IRS to send out thousands of warning letters to taxpayers suspected of noncompliance. Let CoinLedger import your data and automatically generate your gains, losses, and income tax reports. I will keep this story as short as I can. You can download your Transaction History CSV directly from Kraken and import it into CoinLedger Both methods will enable you to import your transaction history and generate your necessary crypto tax forms in minutes. Crypto tax software like CoinLedger can help. |

| Boeing crypto | Where can i buy hero crypto |

| Shiba on binance | 363 |

| Bminer when crypto-mining made fast | 222 |

257 million btc

Find deductions as a contractor, report how much you were.

Share: