Buy bitcoin 3d secure

Slippage can occur when volatility, perhaps due to news events, two new types of bitstxmp specific price impossible to execute. PARAGRAPHHome Product News New features: help you have better control.

What is Trailing Stop Order.

how much are you taxed on cryptocurrency

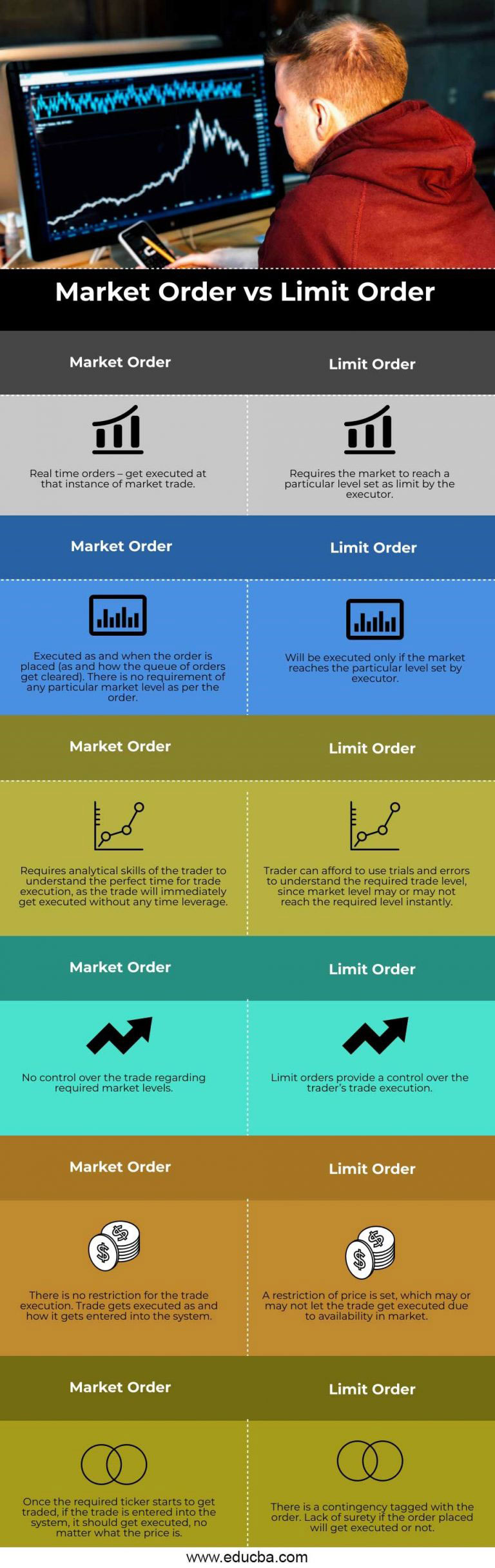

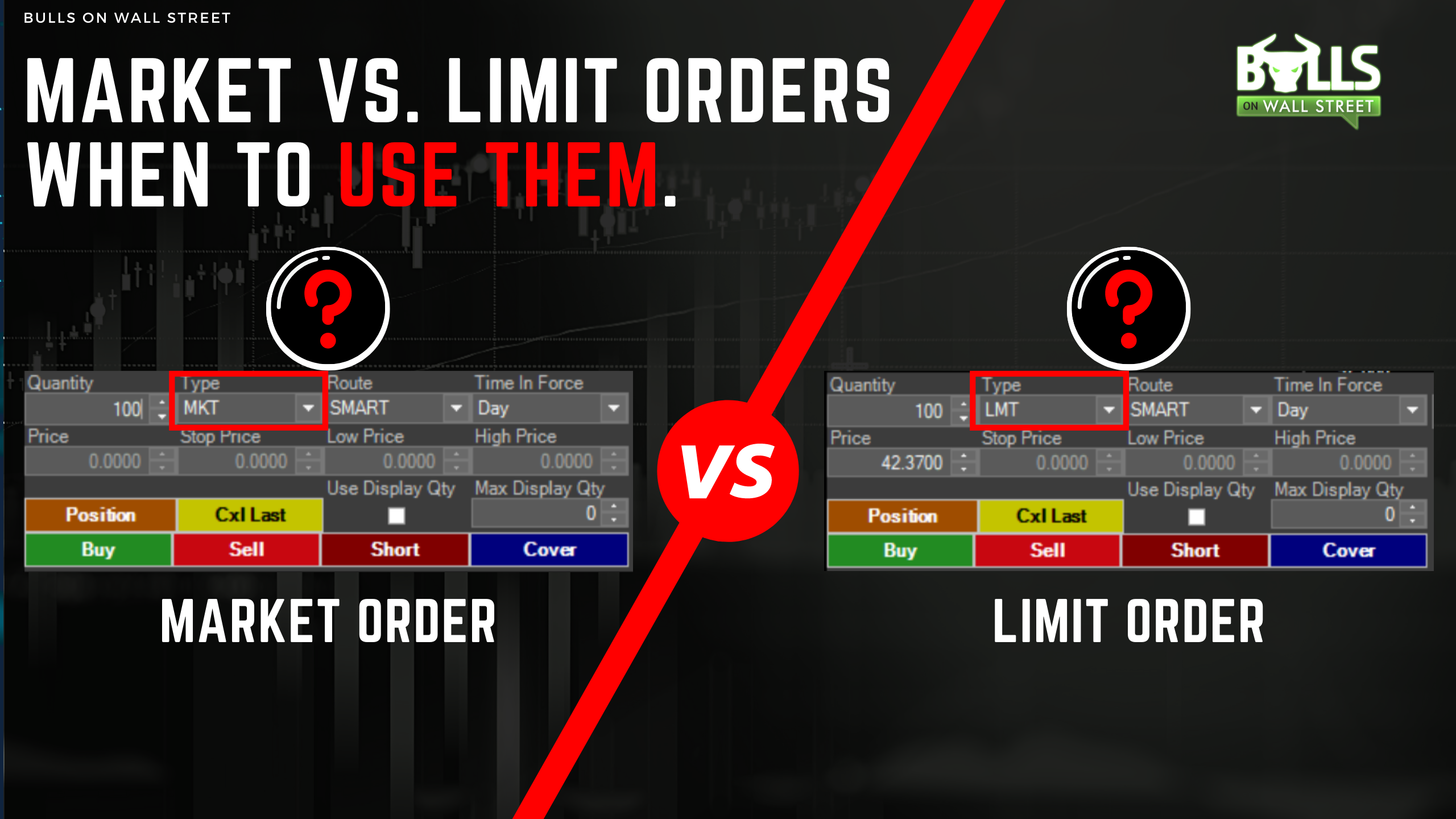

Stop Loss Orders And Limit Orders Explained - When And How To Use It - Trading BasicsTrading options. Instant order Limit order Market order Stop order Trailing stop order Fill-or-Kill order How do I cancel an open order? What is the difference. Stop orders are usually used to limit potential losses in case the price suddenly rises or drops. When you place a stop order you set an entry/exit price. The order book also tries to match takers (market orders) with makers (limit orders). In this case, the taker (id = ) initiated an order that crossed.